In early April, as many small businesses around the world closed their doors, furloughed employees, or scrambled to shift to a purely digital work environment, the U.S. Small Business Administration (SBA) and U.S. Treasury Department rolled out a government-backed lifeline to help entrepreneurs and small businesses. The Paycheck Protection Program (PPP) was established to provide access to capital to eligible small businesses at an attractive rate – with the intent to make these loans forgivable, under certain conditions. The program has been fluid since its inception and the forgiveness component is no exception.

If you are a PPP loan recipient, here are some key things to remember as you prepare to apply for loan forgiveness:

In October, the U.S. Small Business Administration announced a more simplified loan forgiveness process for small businesses that received a PPP loan for $50,000 or less. At Wells Fargo, we received SBA guaranties for more than 194,000 PPP loans, with an average loan amount of $54,000. 78% of these loans were for $50,000 or less and will be able to use a more simplified PPP loan application to apply for forgiveness. PPP loan forgiveness is key to helping businesses reopen and to get our economy moving forward through the pandemic.

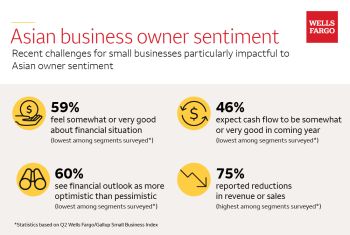

Minority-owned businesses, including those owned by Asian-Americans, have been disproportionately impacted by the pandemic according to a recent study by the U.S. Chamber of Commerce. At Wells Fargo, we’re committed to helping these business owners navigate the various financial options to weather the uncertainty. While the federal government weighs additional economic stimulus packages, alternative lifelines are available through grants from participating non-profits provided by the Open for Business Fund, a fund created using all gross PPP fees.

For the most up-to-date information on the PPP and details on loan forgiveness, visit the U.S. Small Business Administration.

ABOUT THE AUTHOR

Andrew Moy is an executive vice president and division executive for Wells Fargo’s Commercial Banking Diversified Sector Management. Based in Charlotte, North Carolina, he leads specialized industry teams, including Investor Real Estate, Global Advisory, Waste and Recycling, Heavy Equipment Dealer Group, Employee Stock Ownership Plan financing (ESOP), Defense, Aerospace, and Technology Services (DATS), and Diverse Segments, all focused on serving the financial needs of business banking and middle-market banking customers.